Fiona Woolf, the 2nd female Lord Mayor since 1189

Fiona Woolf, the 2nd female Lord Mayor since 1189

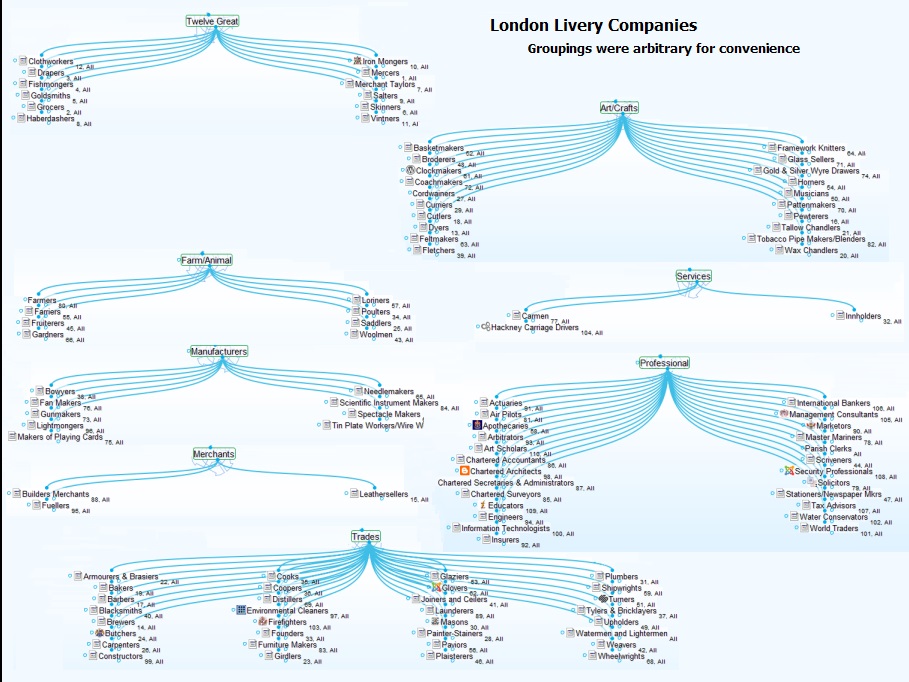

You’re probably wondering how I veered off into the medieval world of the City of London and how that relates to the smart grid so I won’t beat around the bush. Recall that the function the Lord Mayor of London serves is to be an economic ambassador for the City of London and she was elected via the Guild System – Worshipful Companies of the liverys. The Companies have royal patents on trades, crafts and professions. They don’t engage in the profession – they are non-profit (charities under English law) associations representing the interests of the trade including businesses (primarily), tradesmen and most importantly in establishing the rules and standards under which the trade engages in business. Currently there are 112 Worshipful companies with more aiming at becoming patented Worshipful companies. For your convenience, I built a brain so that you can visit their websites, read their history and learn about this medieval system of commercial organization. [Note: sorry, the brain is no longer available online. It cost too much].

Livery Companies

It should be noted that I put the livery companies into categories to make the diagram easier to read. Electricity falls under the Fuellers category. [You can make the image bigger by clicking on the + sign and you can move the image within the box.]

Since the livery companies are charities, they operate without paying taxes but they do pay tributes and do provide support for the monarchy. They collect money from their members who may not do business in a trade without membership because the Company holds the patent.

Another important feature is cooperation by contract. They also affiliate with one or more branches/companies of the military. That is made all the more significant since this system traces it’s roots to the Roman Empire.

What drew my attention to Fiona Woolf (thanks Mark), was that Fiona Woolf was an Energy Consultant.

Fiona Woolf CBE emphasis added

Fiona Woolf has over 20 years experience in dealing with regulation, market design and implementation and major projects in the electricity industry – culminating in a CBE in 2002 for her contribution to the UK knowledge economy and invisible earnings. She has advised over 28 governments.

At CMS Cameron McKenna, Fiona has built an innovative energy and major projects practice that spans law, engineering and economics, successfully building on the gaps and overlaps. Fiona has worked around the globe in India, Australia, Asia, the Middle East, Africa, Central and Eastern Europe, Russia and Scandinavia, establishing a unique reputation.

She was a Member of the Competition Commission from 2005 until 2013. She was a non-executive director of Affinity Water Ltd until December 2013.

Fiona studied Law at Keele University and studied Comparative Law at the University of Strasbourg. She qualified as a solicitor in 1973 and worked in the corporate and banking fields at Clifford Chance. She became a partner in CMS Cameron McKenna in 1981. She was awarded a senior fellowship at Harvard University in 2001/ 2. She has been awarded honorary doctorates by Keele University and the College of Law. It has been announced that she will become Chancellor of the College of Law in November 2014.

Invisible earnings, indeed.

As you read down through the Reforms, Restructurings and Privatisations that she’s been involved with – including Advisor to the World Bank, when you get to Electricity Markets:

California, USA: Preparation of the Phase II (detailed) FERC filing of the documentation to establish the Independent System Operator and the Power Exchange and developing the operating protocols and procedures with the ISO and PX staff. Advised on the regime for existing contracts and ancillary services. Chaired large stakeholder meetings involving all regional participants.

USA: Strategic advisor to Board of PJM Interconnection LLC (Pennsylvania, New Jersey, Maryland) with reference to its role as an independent system and market operator, its governance arrangements, its market power monitoring functions and aspects of its transmission access arrangements and tariffs.

And at the bottom of the page, you’ll see the publications she’s co-authored. I’ve highlighted the one that is most significant for you to see with regard to the connection between deregulation of our critical infrastructure in the U.S. and the Unholy Roman Empire builders of the City of London.

Publications

“Global Transmission Expansion – Recipes for Success” , book published by PennWell Inc, 2002.

World Bank publication entitled “Governance and Regulation of Power Pools and System Operators – An International Comparison” by James Barker, Jr. Bernard Tenenbaum and Fiona Woolf.

World Bank publication entitled “Integrating Independent Power Producers into Emerging Wholesale Power Markets” by Fiona Woolf and Jonathan Halpern.

World Bank publication entitled “Regulation by Contract : A New Way to Privatize Electricity Distribution? ” by Tonci Bakovic, Bernard Tenenbaum and Fiona Woolf.

Coincidently, I was looking at PJM recently in connection with research that I was doing on the Bundy Ranch situation that expanded when I discovered that the transmission lines that Moapa Paiute Indian Tribe was going to use for their solar facility near the Bundy Ranch, belonged to the Reid-Gardner coal-fired power plant that belonged to NV Energy and NV Energy had just been bought by Warren Buffet’s MidAmerican Energy Holdings Company. The Moapa Paiutes sued NV Energy for the alleged toxic environment created by the power plant. Their objective was to force the closure of the plant. With the lawsuit, they succeed. The question was, why did MidAmerican Energy Holdings buy a plant that was going to be shut down? That’s like buying a dead horse and Warren Buffet is not known for buying dead horses. It turns out that the money is made on carbon credits and Renewable Energy Certificates (RECS).

The discovery of RECS led me to discover the Green Power Network and the EPA’s Green Power Partners.

EPA Green Power Partners Click on Fortune 500 Partners… and scroll down to see the list:

Biggest buyers of “green power” are: Intel, Microsoft, Google, Apple, Cisco, Dell and then look at the federal government buyers of “green power” – VA is number 2.

The question is, are they really buying power or are they buying RECS? And who certifies the RECS meaning that so much energy has been generated to produce one?

“RECs are market-based instruments that convey the environmental value of renewable energy between buyers and sellers. Each REC provides exclusive proof that 1 megawatt-hour (MWh) of renewable energy has been generated.2 RECs are widely used to verify compliance with state renewable portfolio standards and to establish environmental claims in the voluntary market. As such, they are the common currency in both compliance and voluntary markets.”

Here is the basic logic problem they were trying to solve with RECS. Electricity from a solar farm for example, flows into the transmission grid and just becomes part of the stream of electricity. When a company uses electricity, they just use electricity from the stream. There is no way to separate “renewable” electricity from electricity generated by traditional sources. That’s why certification of a REC is so important. It may or may not actually represent electricity produced by a renewable source depending upon the integrity of the certifier.

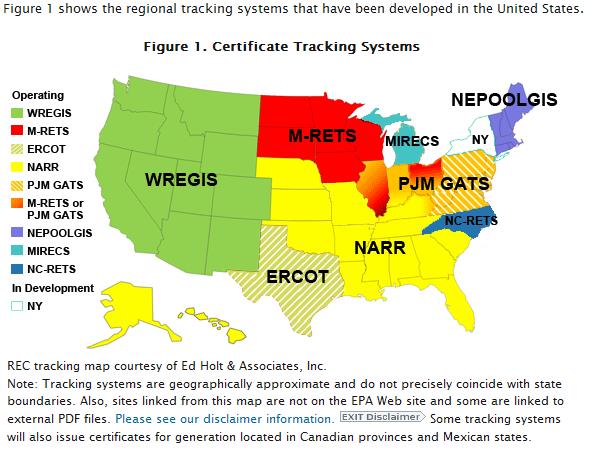

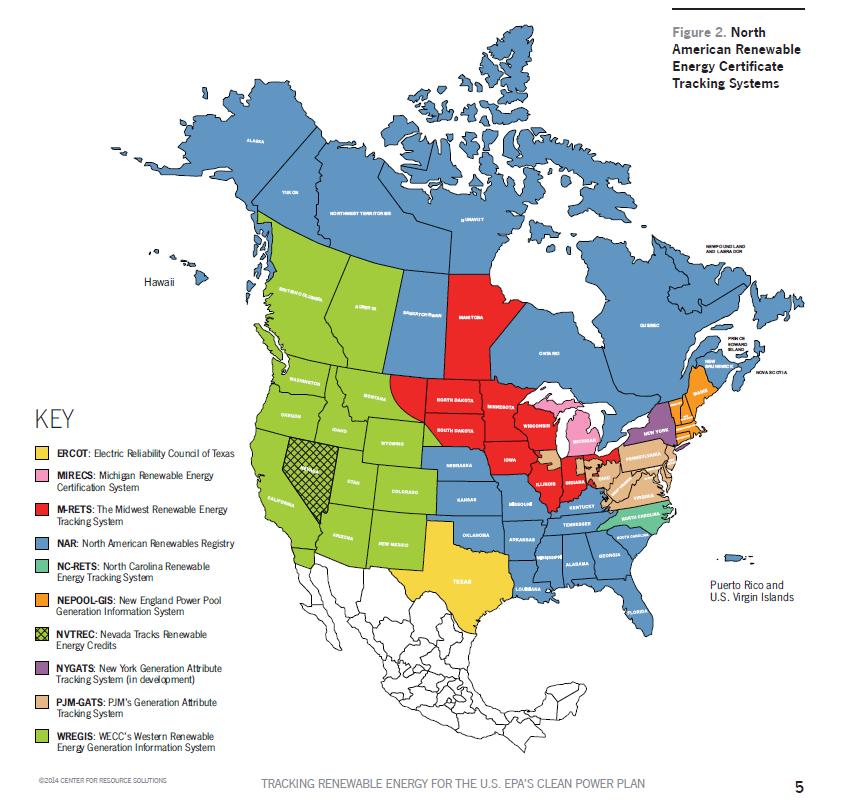

The following map is from the EPA website defining the territories of the systems that certify the production of renewable energy that generates the creation of RECS. The following is the map of tracking territories as they were when this series was written originally in 2015. The map below it is the current map of territories as of 12/19/2017.

The EPA website doesn’t tell you this, but those territories correspond roughly to the Regional Transmission Operator (RTO) organizations. The reason for it not corresponding exactly is because we are talking about systems and systems can overlap territories when two or more RTOs agree to share systems but the key thing is that it is the certification is done by an RTO or a subsidiary of the RTO as in the case of PJM.

The deregulation of our electricity system included decoupling the transmission grid from the electric utilities that built them – creating a separate ‘System Manager’ function to operate the grid. That’s what the RTOs do. They don’t own the transmission lines, they simply run the systems that operate the transmission grid. The RTOs are the “Man in the Middle” so to speak.

PJM was the first Regional Transmission Operator and now we know that Fiona Woolf was the advisor on that deal. And PJM has a subsidiary that is a trading platform for “environmental transactions” so there is an interest in ensuring that there are transactions for the trading platform which presumably means RECS and Carbon Credits (issued for destruction of carbon producing facilities – like real electricity generating facilities.) [Note: the PJM subsidiary PJMEnviroTrade no longer has a separate presence on the web – but the page was captured from the Internet Archive: PJMEnviroTrade

PJM was the first Regional Transmission Operator and now we know that Fiona Woolf was the advisor on that deal. And PJM has a subsidiary that is a trading platform for “environmental transactions” so there is an interest in ensuring that there are transactions for the trading platform which presumably means RECS and Carbon Credits (issued for destruction of carbon producing facilities – like real electricity generating facilities.) [Note: the PJM subsidiary PJMEnviroTrade no longer has a separate presence on the web – but the page was captured from the Internet Archive: PJMEnviroTrade

If you recall, in Chapter 3, I wrote about NERC, the North American Electric Reliability Organization that includes Canada and Mexico. It is an international organization that oversees the efficiency and reliability of our bulk power system – and in particular, the electric transmission grid. They are the self-governance organization for electric utility industry – and it’s by contract. Governance by contract. They were authorized in the Energy Policy Act of 2005 – in the same legislation that Congress ordered the utility companies to offer smart meters – because the smart meters are needed for renewable energy inputs to the electric transmission grid system.

Only the map is not quite accurate because another organization has been created by contract between NPCC, FRCC, MRO, RFC, SERC and SPP – creating a new organization for oversight called the Eastern Interconnection Reliability Assessment Group (ERAG).

Recently, NERC terminated their agreement with WECC and they are transferring those responsibilities to NPCC – so in effect, the NPCC (New York) will have the reliability and complaince responsibilities for virtually the whole country – except Texas – so far.

[Note: for some reason I had a problem with this link – probably because of the spaces between the words. I made a copy of the file and that’s the link above. Here is the link that wordpress couldn’t handle:

http://www.nerc.com/FilingsOrders/us/Regional Delegation Agreements DL/NPCC_WECC_Agreement_20120101.pdf

So what does it mean? It means that the Regional Transmission Operators and their subsidiary energy trading companies have a printing press for money with no oversight because nobody really knows how much actual renewable energy is being produced except the RTOs. The RTOs are under an industry self-regulatory system and they do the accounting and their trading companies do the trading of the RECs.

And just in case you’re thinking that I’m just being conspiracy minded, consider this… another British wench named Blythe Masters – the…. woman who conceived of the idea of derivatives was at the center of the most recent energy fraud case –

JP Morgan Energy Traders May Face FERC case

Blythe Masters’ “Get-Out-Of-FERC-Jail-Free Card May Cost JP Morgan $500mm (petty cash)

Blythe Masters, JP Morgan’s Credit Derivatives Guru Is Not Sorry

What is a REC really? A REC is a derivative. And the whole system is what I would call a Livery Company fraud scheme to produce “invisible earnings”.

Emerging Markets for Renewable Energy Certificates Opportunities and Challenges (Pg 13)

Renewable energy certificates (RECs) represent the attributes of electricity generated from renewable energy sources. These attributes are unbundled from the physical electricity, and the two products—the attributes embodied in the certificates and the commodity electricity—may be traded separately. RECs are quickly becoming the currency of renewable energy markets, primarily because of their flexibility and the fact that they are not subject to the geographic and physical limitations of commodity electricity. RECs are currently used by utilities and marketers to supply renewable energy products to end-use customers as well as to demonstrate compliance with regulatory requirements, such as renewable energy mandates

Oh… one other note. The tech companies can buy so many RECS because they are simply a business investment that will be made up through the sale of technology for the Smart Grid and Smart Grid devices so it’s in their interest to play the game.

Update 12/19/2017

Yesterday Infowars did a 38 hour Christmas special program. Hour 21 had two young hosts who had a discussion on bitcoin. At some point during the discussion, they talked about China and their electricity system relative to bitcoin. As I listened, the thought occurred to me that bitcoins may represent Renewable Energy Credits (REC). As I understand it, the government agencies must buy renewable energy credits representing electricity generated with renewable energy. Essentially what they’ve done with these RECs is to create a parallel financial system in which the RTOs can basically print money because they are the ones who certify the infeed of electricity to the transmission grid from renewable sources.

How China fits into this picture is that at the intermodal commerce zones (inland ports) and near all federal facilities, the Chinese are investing in renewable energy facilities. If you look at the map above labeled North American Renewable Energy Certificate Tracking Systems, you’ll notice that the entire state of Nevada has been carved out. Renewable Energy Certificates for Nevada are tracked by NVTREC – Nevada Tracks Renewable Energy Credits.

These are observations that require more investigation to determine what is really going on.